40 jp morgan oil price forecast 2022

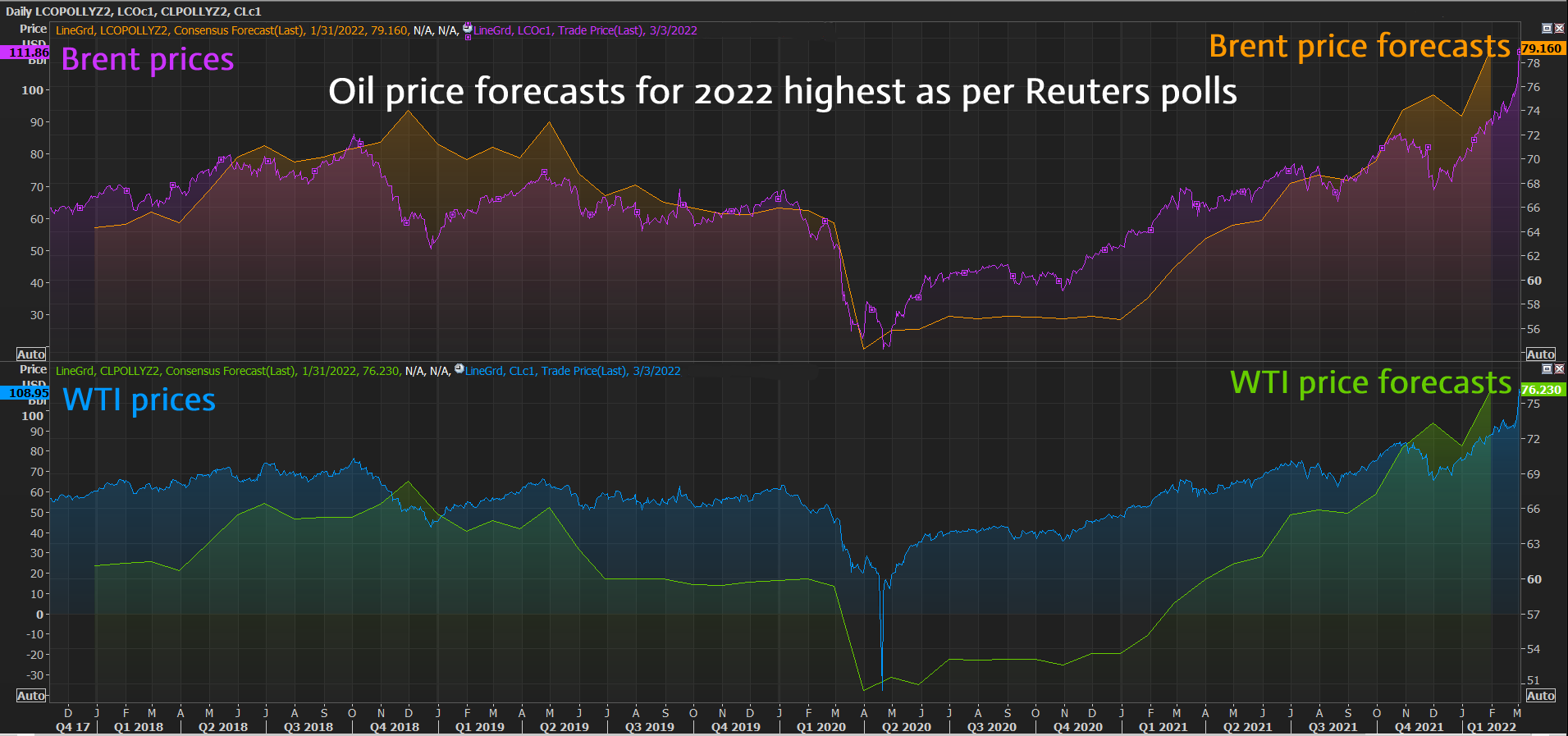

Factbox-JP Morgan says oil demand to surpass 2019 levels ... The bank expects global oil demand to grow 3.5 million barrels per day (bpd) in 2022 to reach 99.8 million bpd, which would be 280 kilo bpd above 2019 levels. The bank also expects Brent oil prices... J.P.Morgan sees gold price unable to withstand the Fed ... At the same time, J.P.Morgan expects the U.S. dollar to rise 1.6% next year. Looking at economic growth forecasts, J.P.Morgan expects the global economy to 4.8% in 2022, with the U.S. economy expanding 3.8%. While the U.S. bank is bearish on gold through 2022, the bank is bullish on the rest of the commodity complex.

JPMorgan Sees Natural Gas Crisis Pushing Oil to $84 By Year ... October 2, 2021 - To continue, please click the box below to let us know you're not a robot · Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy

Jp morgan oil price forecast 2022

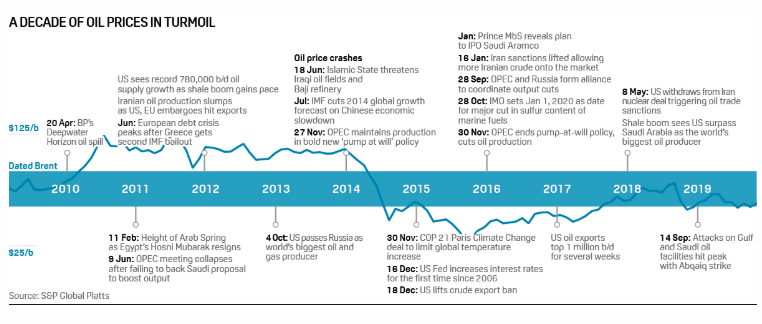

Oil could vault as high as $150 a barrel, veteran analyst warns Oil prices are soaring and nothing appears to be stopping their ascent. ... bullish call — J.P. Morgan this month forecast oil as "likely to overshoot to $125" per barrel "on widening spare ... Oil will spike to $150 in 2023, JPMorgan predicts - CNN November 30, 2021 - The surge in oil prices this year has angered drivers, tainted Americans' views on the economy and confounded both the White House and Federal Reserve. Unfortunately, JPMorgan Chase says the oil spike is just getting started. The State of the Oil Market - JP Morgan December 15, 2021 - In this video, Commercial Banking Head Economist Jim Glassman and Abhishek Deshpande, Corporate & Investment Bank’s Head of Oil Market Research and Strategy, discuss the current energy environment—including promising global developments and risk scenarios.

Jp morgan oil price forecast 2022. JPM - JP Morgan Chase & Company Stock Price - Barchart.com Price/Cash Flow: Latest closing price divided by the last 12 months revenue/cash flow per share. Price/Book: A financial ratio used to compare a company's current market price to its book value. Price/Earnings: Latest closing price divided by the earnings-per-share based on the trailing 12 months. Companies with negative earnings receive an "NE." Gas prices could double next year, JP Morgan oil analysis ... The J.P. Morgan analysis was published on Nov. 29 and is predicting crude prices will average $88 per barrel in 2022 before "overshooting" to the $125 price point. Malek's report said part of the... Oil prices likely to hit $125 per barrel in 2022: JPMorgan Oil prices likely to hit $125 per barrel in 2022: JPMorgan "As the group's (OPEC+) real volume potential is discovered, this should drive a higher risk premium to oil prices," the bank said in a... Oil price could rise to $125 per barrel in 2022, warns US bank ... December 1, 2021 - US bank JP Morgan, in a new report, has revealed that the oil prices could surge by 66 per cent in 2022, which is US $125 per barrel. Crude oil could cost as much as US $150 per barrel by 2023. As per Christyan Malek, JP Morgan's head of oil and gas research, the main issue is that the OPEC ...

JPMorgan's S&P 500 forecast for 2022 is among the most ... In our call of the day, JPMorgan predicts a 5,050 finish in 2022 for the S&P 500 SPX, which matches RBC's forecast and looks among the most optimistic on Wall Street so far. Read: Omicron may delay... Price impact from oil reserves release unlikely to last long- JP ... November 24, 2021 - On the demand front, JP Morgan forecast that global oil consumption would surpass 2019 levels by March 2022. The U.S. bank also projected that Brent oil prices would average $88 per barrel in 2022 and $82 per barrel in 2023, breaching $90 per barrel sometime in the third quarter of 2022. Nigeria sues JP Morgan for $1.7 billion over oil deal | Nasdaq Feb 23, 2022 · A London court will on Wednesday begin to hear a lawsuit launched by Nigeria against U.S. bank JP Morgan Chase, claiming more than $1.7 billion for its role in a disputed 2011 oilfield deal. Have Oil Prices Reached an Inflection Point? - JP Morgan May 27, 2020 - J.P. Morgan Research takes a look at global oil demand, the impact of supply cuts & the differences in price between two major oil benchmarks. Read more

The soaring price of gasoline is a major element of the ... Iraqi minister says high oil prices, if they last, could speed the shift to E.V.s. ... predicting that annual inflation for 2022 would be 5.1 percent, up from a forecast of 3.2 percent three ... Oil rally to power on as sanctions on Russia throttle ... Among the most bullish predictions, JP Morgan expects $185 oil by the end of 2022 if disruption to Russian exports lasts that long, although its average for the year was $98. JP Morgan sees oil prices hitting $125 in 2022, $150/bbl ... December 3, 2021 - “We think OPEC+ will slow committed increases in early 2022, and believe the group is unlikely to increase supply unless oil prices are well underpinned,” the bank said. The bank forecast global oil demand to reach 99.8-101.5 million barrels per day in 2022-23. JP Morgan sees oil prices surging to US$125 in 2022 before ... Oil prices will surge around 66% to US$125 per barrel in 2022, according to JP Morgan, which sees the crude market at the start of a new super-cycle'. Crude could reach as high as US$150 per barrel...

Oil Will Hit $125 a Barrel in 2022, $150 in 2023: JPMorgan November 30, 2021 - OPEC production shortfalls will spark the move, J.P. Morgan says. 'OPEC+ is not immune to the impacts of underinvestment.'

JPMorgan Chase - Wikipedia JP Morgan Chase's PAC and its employees contributed $2.6 million to federal campaigns in 2014 and financed its lobbying team with $4.7 million in the first three quarters of 2014. JP Morgan's giving has been focused on Republicans, with 62 percent of its donations going to GOP recipients in 2014.

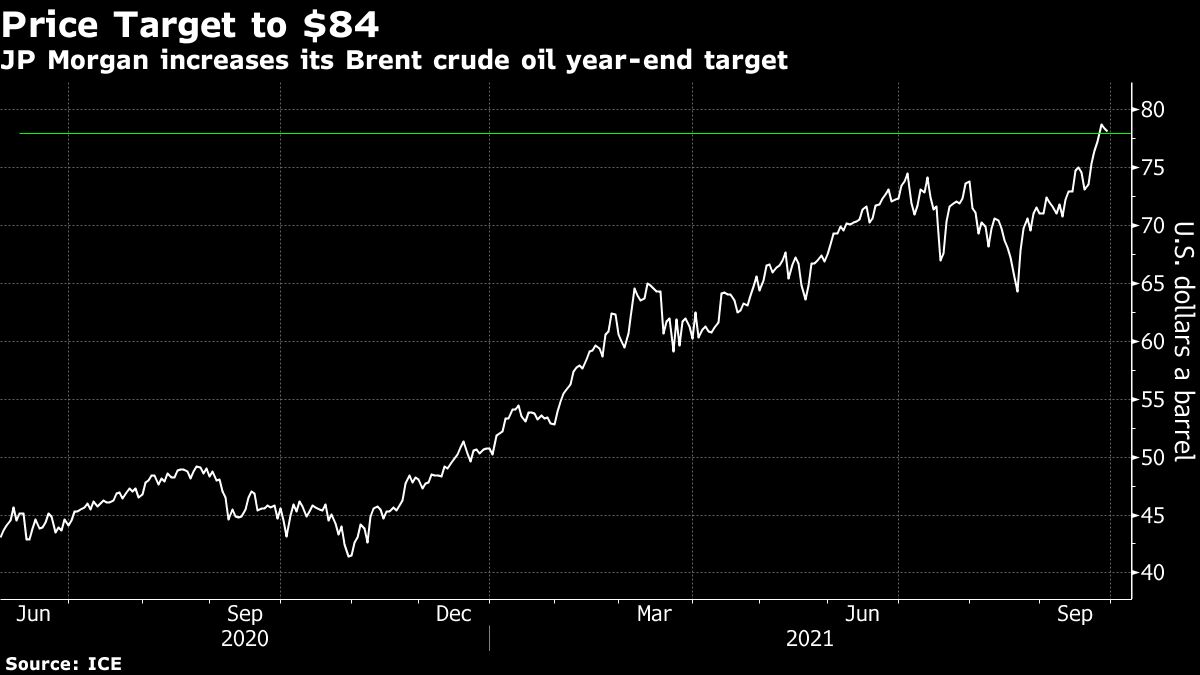

JPMorgan Analysts Explain Why Oil Could Hit $80 By Year End | Barron's July 20, 2021 - Expanding demand for oil as economies rebound from the pandemic is going up against a lack of supply.

JP Morgan Forecasts $125 Oil Price in 2022, $150/bbl in 2023 December 7, 2021 - Emmanuel Addeh in Abuja Oil prices are expected to overshoot $125 a barrel next year and $150 in 2023 due to capacity-led shortfalls in the Organisation of Petroleum Exporting Countries (OPEC) prod…

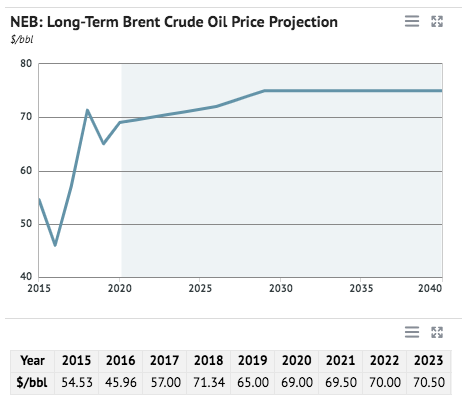

US EIA forecasts $70/b oil price, JP Morgan sees it at $125 Brent crude oil futures prices will average 70 U.S. dollars per barrel in 2022," the agency stated in the outlook. But, in a bullish report from JP Morgan, analysts are predicting $125 oil this year and $150 oil in 2023. The forecast, according to the report, is driven by the belief that OPEC has a limited capacity to increase oil production.

Outlook 2022: Preparing for a vibrant cycle | J.P. Morgan ... The foundation for a vibrant cycle. The global crisis has shifted policymaker priorities, solidified household and corporate balance sheets, and embedded innovation. This should set the table for more potent economic growth in the 2020s than we saw in the 2010s. USD4 trillion U.S. Government has spent in response to the pandemic 1.

JP Morgan sees oil prices surging to US$125 in 2022 before hitting ... November 29, 2021 - Oil prices will surge around 66% to US$125 per barrel in 2022, according to JP Morgan, which sees the crude market at the start of a new super-cycle’. Crude could reach as high as US$150 per barrel by 2023, the US bank said. “OPEC+ is back in the oil market driver’s seat,” JPM analyst ...

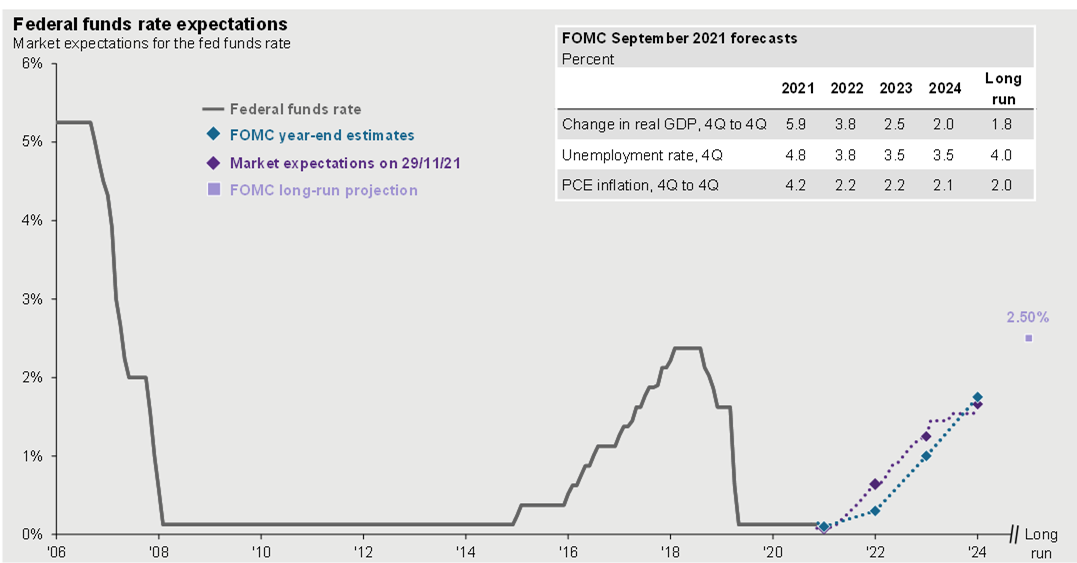

Gold Price Forecast 2022: A Contrarian View To JPMorgan's ... According to a 2022 market outlook report published by J.P. Morgan Global Research recently, the gold price will be under pressure given the tightening monetary policy by Fed this year. "An ...

JP Morgan sees OPEC spare capacity falling through 2022 ... JP Morgan on Wednesday said it expects Organization of Petroleum Exporting Countries' spare capacity to fall through 2022, driving a higher risk premium to oil prices. JPM forecasts oil prices to rise as high as $125 a barrel this year and $150 a barrel in 2023. "We see growing market recognition of global underinvestment in

2022 Market Outlook | J.P. Morgan Global Research We expect 10-year yields to rise to 2% by mid-2022 and 2.25% by the end of 2022," said Jay Barry, Head of USD and Bond Strategy at J.P. Morgan Research. J.P. Morgan Research is forecasting 1.6% gains in the USD index in 2022.

JP Morgan sees oil prices hitting $125 in 2022, $150/bbl ... December 3, 2021 - Oil prices are expected to overshoot $125 a barrel next year and $150 in 2023 due to capacity-led shortfalls in OPEC+ production, JP Morgan Global Equity Research said.

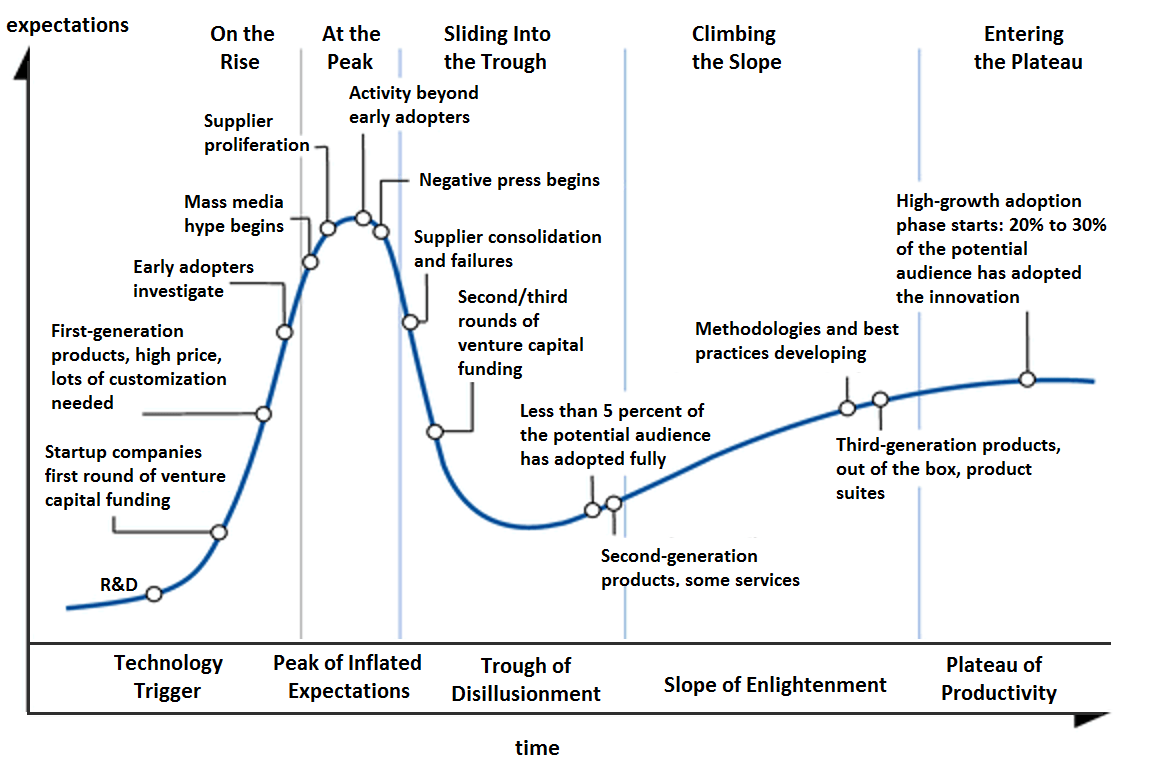

JP Morgan enters metaverse, opens lounge in Decentraland and ... Feb 15, 2022 · Banking giant JP Morgan enters the metaverse with the launch of its Oynx lounge in Decentraland. ... 2/15/2022 10:02:35 PM ... Decentraland price posted double-digit gains as institutions drive ...

$190 oil sounds crazy. But JPMorgan thinks it's possible even after ... June 19, 2020 - In a little-noticed report, JPMorgan Chase warned in early March that the oil market could be on the cusp of a "supercycle" that sends Brent crude skyrocketing as high as $190 a barrel in 2025.

JP Morgan sees oil prices hitting $125 in 2022, $150/bbl ... JP Morgan sees oil prices hitting $125 in 2022, $150/bbl in 2023. December 2, 2021, 7:09 AM. FILE PHOTO: An oil pump is seen near Bakersfield. (Reuters) - Oil prices are expected to overshoot $125 ...

JP Morgan sees oil prices hitting $125 in 2022, $150/bbl ... Dec 2 (Reuters) - Oil prices are expected to overshoot $125 a barrel next year and $150 in 2023 due to capacity-led shortfalls in OPEC+ production, JP Morgan Global Equity Research said. "As the...

Oil will spike to $150 in 2023, JPMorgan predicts - CNN Importantly, JPMorgan is not calling for oil to trade at $125 a barrel for all of 2022. Instead, the bank is predicting crude will average $88 next year and "overshoot" to $125 at some point....

Oil Prices Projected To Hit $125 In 2022 | OilPrice.com Nov 30, 2021 · In a new report from JP Morgan, analysts are predicting $125 oil next year and $150 oil in 2023 This bullish forecast is driven by the belief that OPEC has a limited capacity to increase oil ...

JP Morgan Predicts $100 Oil | OilPrice.com The current situation is fundamentally no different, according to JP Morgan's analyst, who expects the oil market to swing into a deficit sometime in 2022, which would push Brent to $60. This, in ...

Soaring prices set stage for eventual reversal of oil, gas ... It raised its 2022 forecast by nearly 800,000 barrels per day, predicting a need for an additional 3.2 million bpd this year, to well above the 100 million bpd pre-pandemic level of 2019.

What's Next For Oil And Gas Prices As Sanctions On Russia ... 1 week ago - Morgan baseline view calls for the Brent oil price to average $110 /bbl in the second quarter of 2022, $100/bbl in 3Q22 and $90/bbl in 4Q22, with the possibility that prices rise as high as $120/bbl in the interim, depending on the state of geopolitics. This represents an 11% increase on J.P. Morgan’s November forecast...

JP Morgan sees OPEC spare capacity falling through 2022 | Reuters January 13, 2022 - Jan 12 (Reuters) - JP Morgan on Wednesday said it expects Organization of Petroleum Exporting Countries' spare capacity to fall through 2022, driving a higher risk premium to oil prices. JPM forecasts oil prices to rise as high as $125 a barrel this year and $150 a barrel in 2023.

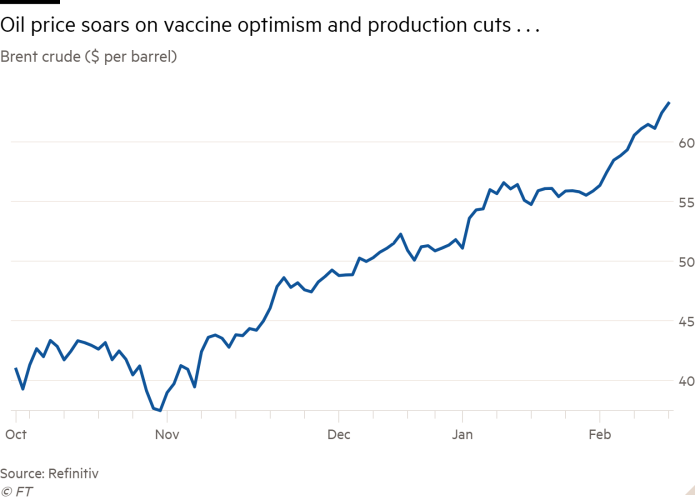

Why are oil prices soaring? | J.P. Morgan Asset Management Oil prices have risen substantially this year; WTI crude is up 60.1% to $77.43/bbl and Brent has risen 58.1% to $80.98/bbl 1.While it was expected that easing pandemic conditions would support demand for oil, the move in spot prices this year has caused investors to question whether these price pressures will persist and lead to higher inflation.

Why are oil prices soaring? | J.P. Morgan Asset Management October 8, 2021 - While it was expected that easing pandemic conditions would support demand for oil, the move in spot prices this year has caused investors to question whether these price pressures will persist and lead to higher inflation.

JP Morgan Predicts The End Of Covid, A Strong Economy, And $125 ... December 9, 2021 - JP Morgan is very bullish about the global economy in 2022, a forecast that supports the bank’s earlier claim that oil prices may hit $125 next year

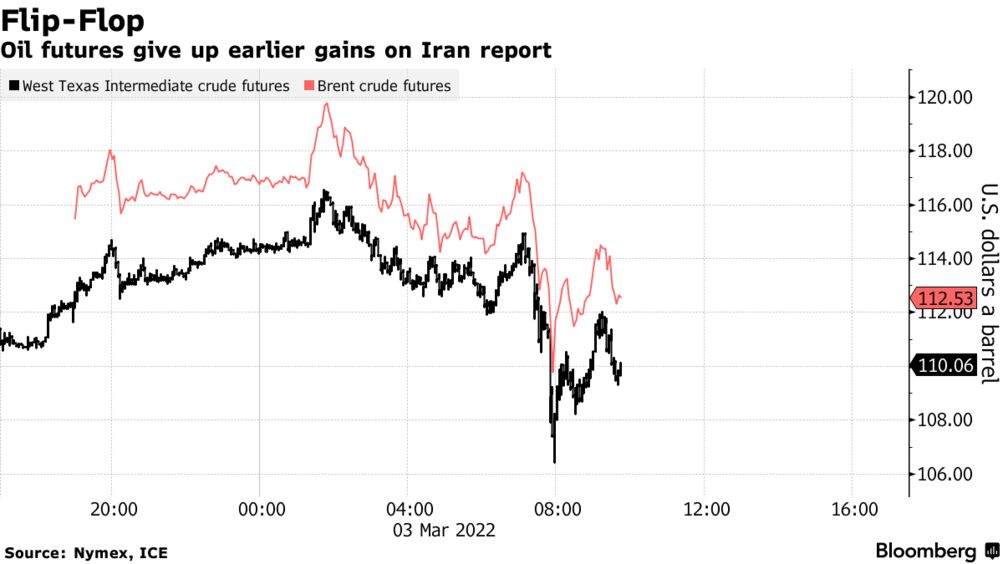

JPMorgan (JPM) Says $185 Oil in View If Russian Supply Hit ... March 3, 2022, 7:58 AM PST. Brent crude could end the year at $185 a barrel if Russian supply continues to be disrupted, JPMorgan Chase & Co. wrote in a note Thursday. Oil prices have skyrocketed ...

Jpmorgan Chase & Stock Forecast & Predictions: 1Y Price ... On average, analysts forecast that JPM's EPS will be $11.12 for 2022, with the lowest EPS forecast at $10.50, and the highest EPS forecast at $12.10. On average, analysts forecast that JPM's EPS will be $12.40 for 2023, with the lowest EPS forecast at $11.45, and the highest EPS forecast at $13.23.

The State of the Oil Market - JP Morgan December 15, 2021 - In this video, Commercial Banking Head Economist Jim Glassman and Abhishek Deshpande, Corporate & Investment Bank’s Head of Oil Market Research and Strategy, discuss the current energy environment—including promising global developments and risk scenarios.

Oil will spike to $150 in 2023, JPMorgan predicts - CNN November 30, 2021 - The surge in oil prices this year has angered drivers, tainted Americans' views on the economy and confounded both the White House and Federal Reserve. Unfortunately, JPMorgan Chase says the oil spike is just getting started.

Oil could vault as high as $150 a barrel, veteran analyst warns Oil prices are soaring and nothing appears to be stopping their ascent. ... bullish call — J.P. Morgan this month forecast oil as "likely to overshoot to $125" per barrel "on widening spare ...

/cloudfront-us-east-2.images.arcpublishing.com/reuters/UOL4PLA6WBK6FJ7RFF3KGNMNXA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/44JBS2H7ONIJ5GYHSDXFXJZ22E.png)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/M25IMBCF6NNXFIEBUJU5HRMCXM.jpg)

0 Response to "40 jp morgan oil price forecast 2022"

Post a Comment