42 defined contribution pension plan canada

[PDF] Defined Contribution Plans For Retirement Free ... Start-to-finish guidance toward building and implementing a robust DC plan Successful Defined Contribution Investment Design offers a comprehensive guidebook for fiduciaries tasked with structuring and implementing a 401(k) or other defined contribution (DC) pension plan. › what-we-do › wealth-andDefined Benefits Pension Plan - Mercer Mercer can help defined benefits plans manage persistent risks, such as market volatility, uncertain liabilities, and pressure to reduce expense and contributions. To find out more about Mercer’s solutions for defined benefit pension plans please contact us.

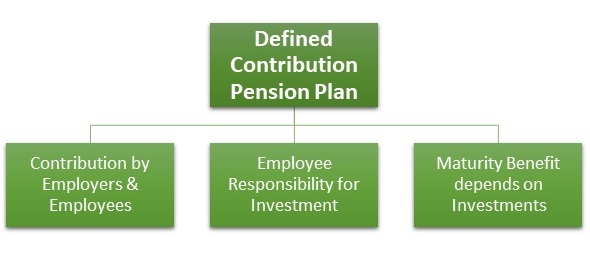

Defined Contribution Plans - GroupBenefits.ca Defined Contribution Plans Under a Defined Contribution Pension Plan (also called a "Money Purchase" Pension Plan), the contributions of plan members and plan sponsors are invested towards the funding of a retirement income. The maximum combined contribution is the lesser of 18% of earned income to the maximum contribution limit.

Defined contribution pension plan canada

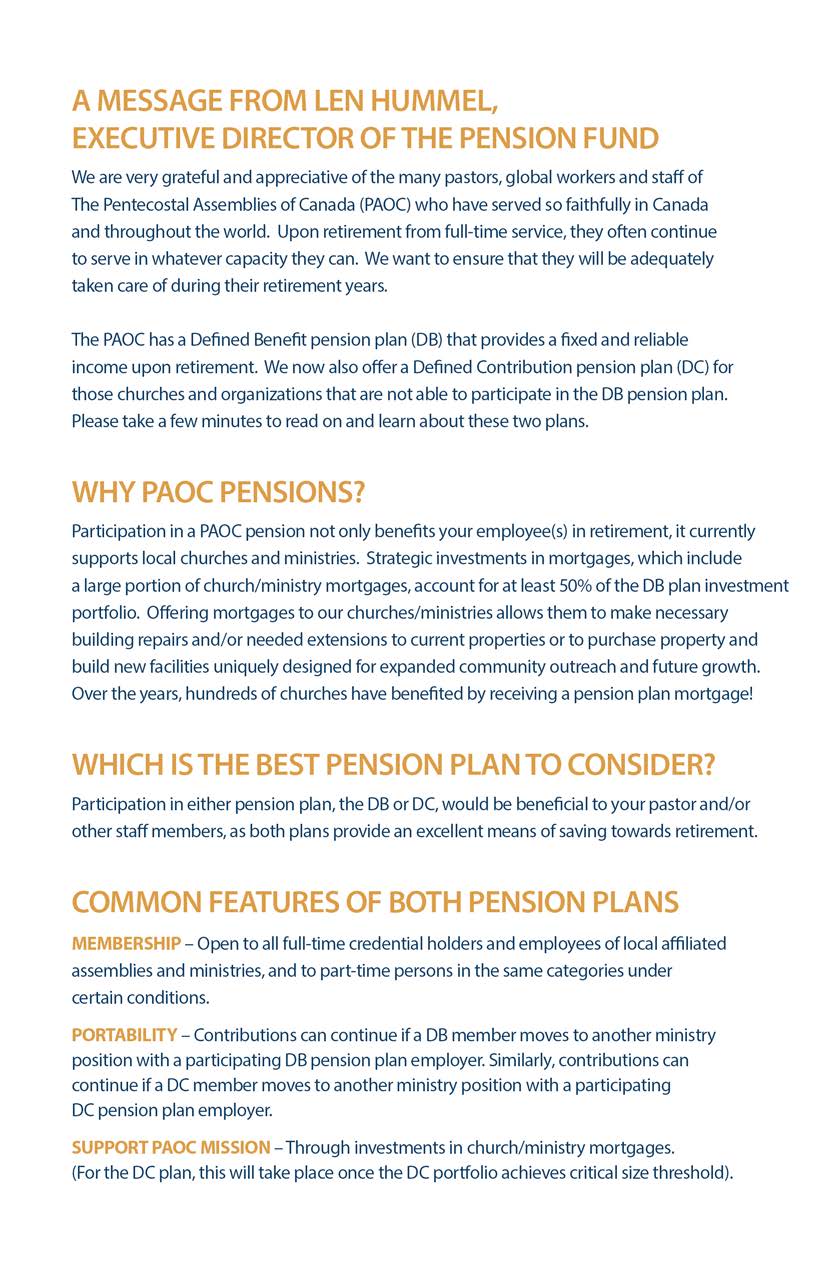

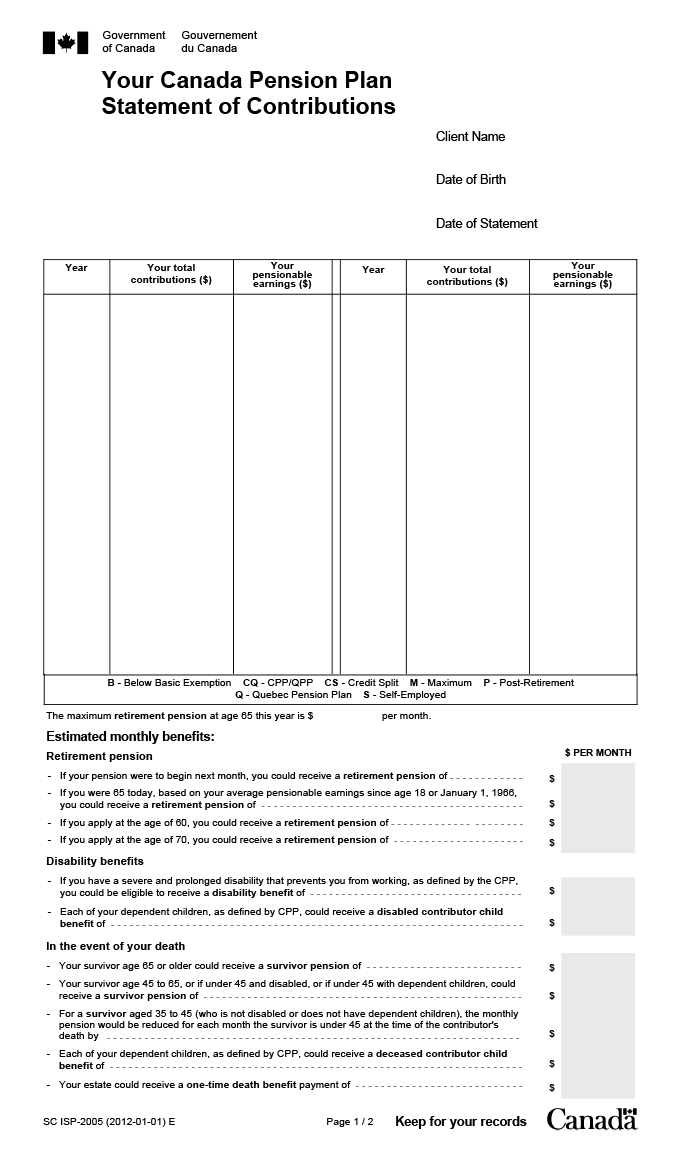

› employer-sponsored-pensionEmployer-sponsored pension plans - Canada.ca Defined contribution pension plans In a defined contribution pension plan, you know how much you will pay into the plan but not how much you will get when you retire. Usually you and your employer pay a defined amount into your pension plan each year. The money in your defined contribution pension is invested in one or more products on your behalf. Defined Benefit Plan Defined Benefit Plan. A defined benefit plan provides members with a defined pension income when they retire. The formula used to determine a member's benefit usually involves factors such as years of membership in the pension plan and the member's salary, and is not dependent on the investment returns of the plan fund. Defined contribution pension plan - finiki, the Canadian ... Canada Pension Plan (CPP) Québec Pension Plan (QPP) CPP and QPP calculator v t e A defined contribution pension plan ( DCPP or DC plan ) is one type of a Registered Pension Plan. A DCPP has no pre-determined payout at retirement, it is based on the assets in the plan at the time your retire.

Defined contribution pension plan canada. TaxTips.ca - Defined Contribution Pension Plan Characteristics Characteristics of Defined Contribution Pension Plans (Money Purchase RPPs) Pensionable age is specified by the pension plan and can vary from plan to plan. Pension payments cannot be split between spouses, except in the case of a court ordered split, due to separation or divorce. PDF Defined Contribution Pensions: Plan Rules, Participant ... Over the last 20 years, defined-contribution pension plans have gradu-ally replaced defined benefit pension plans as the primary privately-sponsored vehicle to provide retirement income. At year-end 2000, employers sponsored over 325,000 401(k) plans with more than 42 mil-lion active participants and $1.8 trillion in assets.1 Defined Benefit vs Defined Contribution Pension Plans ... With a defined contribution plan, sometimes referred to as a group RRSP, the employee contributes a specific amount of their paycheque (usually a percentage, but it could be a fixed dollar amount)... Defined Contribution Pension Plan - RBC Royal Bank Royal Bank of Canada (RBC) is acting in its capacity as a delegate of your employer in connection with its Defined Contribution Pension Plan. MyAdvisor is a platform provided by RBC. Financial planning services and investment advice provided in connection with any RBC investment account opened outside the Defined Contribution Pension Plan is ...

Defined-Contribution Plan Vs. Defined-Benefit Pension Plan ... On the other hand, a Defined-Contribution Pension Plan grants employees the opportunity to contribute funds over time to save for their retirement and the employer provides matching contributions to a certain amount. Your employer may also have a Deferred Profit Sharing Plan (DPSP) for you upon retirement. wealthawesome.com › defined-contribution-pensionDefined Contribution Pension Plan in Canada: Complete Guide The Defined Contribution Pension Plan in Canada is one of the two popular pension plans used by Canadians. A Defined Benefit Pension Plan (DBPP) differs from a Defined Contribution Pension Plan in several ways: The company offering DBPP guarantees a fixed amount of income for their employees after their retirement. The DBPP is not a portable plan. Defined contribution pension options at retirement ... The minute you want income from your defined contribution pension, you will need to utilize a LIF or Life annuity. When this happens, you have a one time opportunity to 'unlock' 50% of your pension assets and move them to a RRSP. Examples Here's a few simple examples: Jacques is 52 working and living in Ontario and has $288,000 in his DC pension. What is a defined contribution plan? | BlackRock A defined contribution plan is a common workplace retirement plan in which an employee contributes money and the employer typically makes a matching contribution. Two popular types of these plans are 401 (k) and 403 (b) plans. Defined contribution plans are the most widely used type of employer-sponsored benefit plans in the United States.

PDF Defined Contribution Pension Plan - Ontario Tech University This booklet describes the rules of your defined contribution pension plan (DCPP) which is registered under the Income Tax Act (Canada) and the Pension Benefits Act (Ontario) registration number 1087808. The Plan was established with an effective date of January 1, 2003 and a December 31st year end. Defined Contribution Plan Defined Contribution Plan Defined Contribution Plan In a defined contribution plan, the employer and employee contribute a set or defined amount and the amount of pension income that the member receives upon retirement is determined by, among other things, the amount of contributions accumulated and the investment income earned. What is a defined benefits pension plan? - Canada Life Canada Life only offers defined contribution plans, but you may have a defined benefit plan from another provider or an older plan. Defined benefit plans can be complicated, but here are the basics. Complex formula, consistent results With a defined benefit plan, your retirement income is decided by a formula. Defined Contribution Pension Plans Vs Group Rrsp: a Guide ... Defined Contribution Pension Plans and Group RRSPs both require that employees stop contributing to the plan and start drawing on the funds at age 71. At this point, employees must convert the plans to an income fund that will pay them out a retirement income. For Defined Contribution Pension Plans, this fund is called a Life Income Fund (LIF).

Defined Benefit Pension Plan in Canada: Fully Explained The DBPP is one of the two main pension plans used in Canada. The Defined Contribution Pension Plan (DCPP) is another pension plan that has become popular over the years. It can differ in several ways from the DBPP including: A DCPP requires employees to make contributions to their plan, and the employer may match their payments.

cpcpension.com › homepage › index-eCanada Post | Pension Plan Membership is restricted to employees who meet the eligibility requirements of the Canada Post Corporation Registered Pension Plan. The official text of the Plan governs the actual benefits from the Plan and is the final authority in any case of dispute.

Defined Contribution Pension Plans: Did You Know? 6 CAPSA Defined Contribution Pension Plans: Did You Know 3Financial Consumer Agency of Canada, Key Findings from the 2019 Canadian Financial Capability Survey. Enrolling Today Can Increase Your Savings If you have the option to enroll in a DC pension plan you should consider it.

Defined contribution pension plan - Canada Life A pension plan is a way for you and your employer to set aside money for your retirement. A defined contribution plan is the most common type of pension. Both you and your employer contribute a percent of your salary over the time that you're working, and when you retire you can convert that money into your retirement income.

PDF 4 Defined Contribution Pension Plan (RPP) Welcome to ... Defined Contribution Pension Plan (RPP) Your Investments In Both The Employee Stock Purchase and Savings Plan & Defined Contribution Pension Plan You can direct the investment of all your contributions in the various Plans. The Plans offer a wide variety of funds from which to select, representing all of the primary asset

› retirement-pensions-2 › 710.2.6 Employer pension plans - Canada.ca A defined contribution pension plan establishes a set amount that you and your company will contribute to your plan each year. The amount is based on how much you make. Defined contribution plans don't guarantee what you will get when you retire; that depends on how well the plan is managed.

Defined Benefit vs Defined Contribution Pension Plans in ... There are two main types of registered pension plans in Canada - the Defined Benefit Pension Plan (DBPP) and Defined Contribution Pension Plan (DCPP). A brief definition of both plans is as follows: Defined Benefit Pension Plan In this pension plan, the employer promises to pay you a predetermined monthly income for life after retirement.

Defined contribution pension plan canada Can you withdraw from a defined contribution pension plan Canada? Defined contribution plans require that you collapse the plan by the end of the year you turn 71. At that point, you can withdraw the funds and pay tax on the income, transfer the assets to a registered retirement income fund ( RRIF ) or purchase an annuity.

› cash-balance-pension-planCash Balance Pension Plan Calculator - Pension Deductions In the defined contribution plan, the benefit is communicated as an account balance in today’s dollars. The cash balance pension plan is a hybrid plan where the benefit is communicated as a dollar amount in today’s dollars and the annuity calculations are done at the back end.

Defined-Benefit vs. Defined-Contribution Plan Differences As the names imply, a defined-benefit plan—also commonly known as a traditional pension plan —provides a specified payment amount in retirement. A defined-contribution plan allows employees ...

Defined-Contribution Plan Definition The defined-contribution plan differs from a defined-benefit plan, also called a pension plan, which guarantees participants receive a certain benefit at a specific future date.

Defined benefit vs. defined contribution: What is the best ... A defined contribution pension plan is one in which the employer and employee make contributions. Those contributions are invested over time to provide a payout at retirement. The final benefit amount of the pension is unknown because it is based on contributions and growth.

› defined-benefit-pension-explainedDefined Benefit Pension Plan Canada: The Ultimate Guide ... Mar 01, 2021 · A defined contribution plan (also known as a DC pension plan in Canada), on the other hand, is funded mainly by you as the employee, but your employer can make contributions (e.g. match your contribution to a defined amount).

Defined contribution pension plan - finiki, the Canadian ... Canada Pension Plan (CPP) Québec Pension Plan (QPP) CPP and QPP calculator v t e A defined contribution pension plan ( DCPP or DC plan ) is one type of a Registered Pension Plan. A DCPP has no pre-determined payout at retirement, it is based on the assets in the plan at the time your retire.

Defined Benefit Plan Defined Benefit Plan. A defined benefit plan provides members with a defined pension income when they retire. The formula used to determine a member's benefit usually involves factors such as years of membership in the pension plan and the member's salary, and is not dependent on the investment returns of the plan fund.

› employer-sponsored-pensionEmployer-sponsored pension plans - Canada.ca Defined contribution pension plans In a defined contribution pension plan, you know how much you will pay into the plan but not how much you will get when you retire. Usually you and your employer pay a defined amount into your pension plan each year. The money in your defined contribution pension is invested in one or more products on your behalf.

0 Response to "42 defined contribution pension plan canada"

Post a Comment